In a fast-evolving financial world, having a reliable and innovative banking partner can make all the difference. Santander México, part of the globally recognized Santander Group, stands out as a leader in the financial services industry. With a focus on digital transformation, personalized banking solutions, and a commitment to empowering customers, Santander México continues to shape the way individuals and businesses manage their finances.

Let’s explore how this forward-thinking institution is redefining the banking experience in Mexico, making financial growth accessible, seamless, and impactful.

A Legacy of Trust and Excellence

Santander México’s roots are deeply intertwined with the Santander Group, a global banking leader with a presence in over 40 countries. This connection provides the bank with a solid foundation of expertise, innovation, and trust built over decades. While it benefits from global insights and resources, Santander México has tailored its offerings to address the unique needs of the Mexican market.

From supporting individuals with everyday banking needs to offering sophisticated solutions for large enterprises, Santander México is a trusted partner for millions of customers.

Digital Banking Redefined

In an era where digital access is paramount, Santander México has taken significant strides to ensure its services are always within reach. The bank’s cutting-edge digital platforms provide customers with tools to manage their finances conveniently, securely, and efficiently.

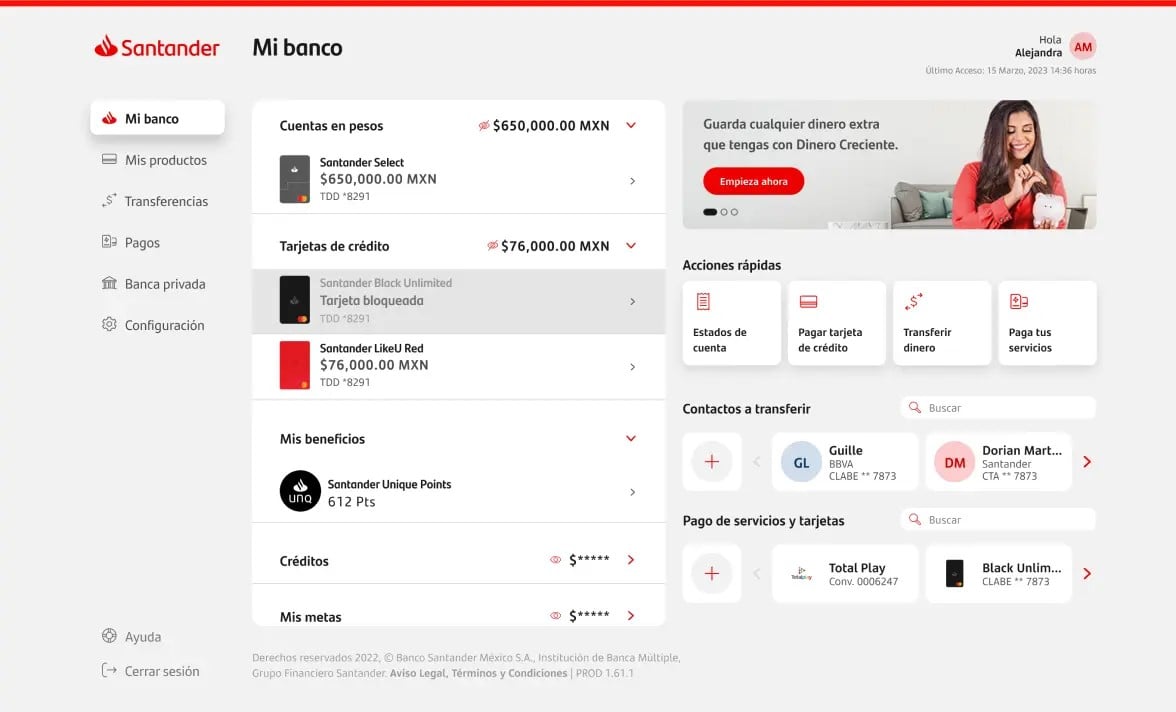

- Santander App: The bank’s mobile app is a cornerstone of its digital offering, allowing users to perform a wide range of transactions, such as transferring money, paying bills, and managing investments, all from their smartphones. With user-friendly navigation and robust security measures, it’s designed to simplify everyday banking.

- SuperDigital: This innovative digital account offers financial inclusion for individuals who prefer an entirely online banking experience. It’s particularly beneficial for those who may not have traditional banking access, making financial services more inclusive and accessible.

- Online Banking: Santander México’s online banking platform provides a seamless desktop experience, allowing customers to monitor accounts, make payments, and even access personalized financial advice from the comfort of their homes or offices.

Personalized Financial Solutions

Santander México believes in creating tailored financial solutions that align with the unique needs of its customers. Whether you’re an individual looking to save for the future or a business seeking growth opportunities, the bank offers a variety of products designed to help you achieve your goals.

- Credit and Debit Cards: From cashback rewards to travel perks, Santander México’s credit card offerings cater to diverse lifestyles and spending habits. Their debit cards provide seamless access to funds, with added benefits like international acceptance and zero fees at Santander ATMs worldwide.

- Loans and Mortgages: The bank’s flexible loan options make it easier for customers to finance significant purchases, consolidate debt, or invest in a home. With competitive interest rates and personalized repayment plans, Santander México simplifies the borrowing process.

- Savings and Investments: For those looking to grow their wealth, Santander México provides a range of savings accounts and investment opportunities. Whether you’re new to investing or a seasoned professional, their expert advisors can guide you in building a portfolio that meets your financial objectives.

Empowering Businesses of All Sizes

Santander México’s dedication to fostering economic growth extends to its comprehensive business banking services. The bank works closely with businesses of all sizes, offering tools to manage finances, access capital, and expand operations.

- Corporate Banking: Large enterprises benefit from tailored solutions, including cash management, trade finance, and structured loans. Santander’s global network ensures businesses have access to international markets and resources.

- Small and Medium Enterprises (SMEs): Recognizing the vital role SMEs play in the economy, Santander México offers specialized products such as business loans, merchant services, and payroll solutions to help smaller companies thrive.

- Startups and Entrepreneurs: For budding businesses, Santander México provides startup-friendly solutions, including microloans and mentorship programs. The bank’s focus on innovation aligns with the dynamic needs of entrepreneurs, helping them turn ideas into reality.

Commitment to Sustainability and Social Responsibility

Santander México goes beyond banking to make a positive impact on society and the environment. Through initiatives aimed at promoting financial literacy, supporting education, and reducing environmental footprints, the bank demonstrates its commitment to creating a sustainable future.

- Financial Education Programs: Santander México actively invests in programs that teach individuals and communities how to manage finances effectively, empowering them to make informed decisions.

- Support for Higher Education: Through scholarships and partnerships with universities, Santander México plays a significant role in advancing educational opportunities for students across the country.

- Green Banking: As part of its commitment to sustainability, the bank has introduced eco-friendly financial products and supports projects aimed at reducing carbon emissions and preserving natural resources.

Building a Brighter Financial Future

At its core, Santander México is more than just a bank—it’s a partner in financial growth and success. By combining cutting-edge technology with personalized services and a deep commitment to customer satisfaction, the bank empowers individuals and businesses to thrive in a dynamic financial landscape.

Whether you’re managing day-to-day expenses, planning for the future, or growing a business, Santander México provides the tools and resources to help you succeed. With its focus on innovation, inclusivity, and sustainability, the bank is paving the way for a brighter financial future.

Discover how Santander México can transform the way you manage your finances. Visit their website to explore their diverse offerings and take the first step toward achieving your goals. Empower your financial journey today with Santander México—where innovation meets opportunity.